Cyber Week 2025 delivered another surge of high-intent shopping, but this year’s data reveals clear signs of a more selective, value-driven consumer. By analysing purchase behaviour across the Skimlinks network, we can identify the verticals generating the highest sales, the brands driving the biggest order values, and the fast-rising challengers gaining momentum year over year.

Top performing verticals: Practicality, comfort, and seasonal readiness

Cyber Week activity centered on categories that blend everyday utility with seasonal demand. Clothing & Accessories led as the most active vertical, an expected strong performer during the gifting period. Meanwhile, Furniture & Décor, Appliances, and Children’s Accessories & Furniture demonstrate that home-focused spending remains resilient.

Seasonal categories made a notable impact too, with Christmas and Registry & Gifting both ranking in the top 10. Early holiday shopping behaviour continues to strengthen, pulled forward by competitive pre-Black-Friday discounts and cost-spreading habits.

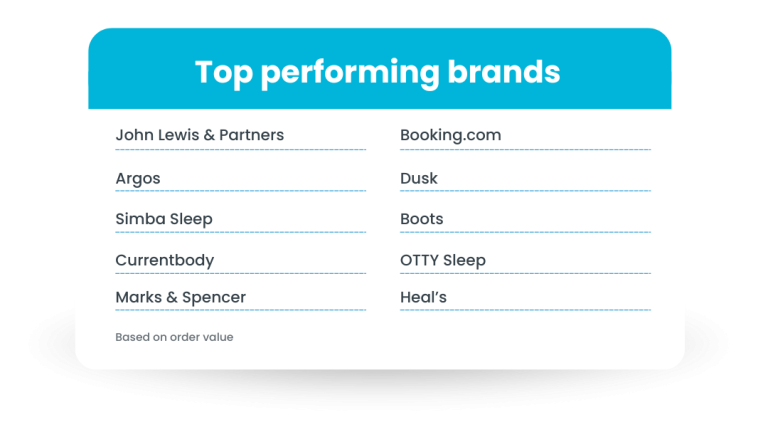

Top performing brands: Retail trust and home comfort drive high-value orders

Cyber Week’s highest-value orders flowed toward top British retailer names and home-comfort specialists.

High-street faithfuls such as John Lewis & Partners, Argos, Marks and Spencer UK, and Boots dominate the list, reinforcing that consumers are favourable towards department stores and marketplaces to consolidate baskets and capitalise on bulk discounts during peak event windows.

Sleep and home-relaxation categories show strong traction too. Simbasleep.com, Dusk.com, and OTTY Sleep each appear in the top 10, pointing to a continued appetite for premium bedding and sleep-quality products.

Biggest risers: Emerging leaders show accelerating momentum

Beyond total sales, Cyber Week reveals which brands are accelerating the fastest. This year’s risers point to a clear trend: consumers are rewarding brands with unique propositions, strong visual identities, and a focused sense of purpose.

Joe & Seph’s Gourmet Popcorn taps into the rising demand for premium snacks and giftable treats. Its strong year-over-year growth indicates that consumers are increasingly seeking small indulgences that feel both personal and shareable.

Fashion, particularly premium, personality-driven fashion, also made a strong showing. Brands like Lulu Guinness, DeMellier, ROKA London, and Spanx appear in the top 10, reflecting a clear shift toward investment accessories and refined essentials. These brands tend to thrive during Cyber Week thanks to high perceived value during discount periods.

Footwear and lifestyle categories also surged, with Hush Puppies and The Sports Edit benefiting from wellness-led purchasing and a continued rise in comfort-first fashion.

Family and gift-focused brands rounded out the list, including The Kid Collective and Whistlefish, both capitalising on early festive shopping and the appetite for personalised or thoughtful gifting.

Want to find out more about partnering with Skimlinks? Click the button below to get started.